Wednesday, 15 September 2021

Tuesday, 14 September 2021

Thursday, 9 September 2021

Wednesday, 8 September 2021

Indices are entering rollover. Those two weeks are the worst two weeks of trading cycle while open interest rolls from September to December. New, fresh direction often comes after expiration.

In a seemingly invulnerable, one-sided market, the only chance bears have, is in finding a slight opening and exploiting it with full-blown aggression.

As it stands now, we know how early it truly is both in today's session and overall with where we are in the bull run to make any presumptions about a market top, let alone a standard correction even underway.

But we do know that bears actually scored some points this morning with their downside pressure on the IWM, ETF for the small cap Russell 2000 Index.

To be sure, without AAPL, FB, GOOGL, MSFT, TSLA and the rest of the gang at least dipping a bit, there really is no broad market correction of which to speak, only constant and grinding rotation like we saw during the summer.

Monday, 6 September 2021

Monday, 16 August 2021

"Be happy."

"We interrupt this program with a special bulletin: America is now under martial law. All constitutional rights have been suspended. Stay in your homes. Do not attempt to contact loved ones, insurance agents, or attorneys. Shut up. Do not attempt to think or depression may occur. Stay in your homes. Curfew is at 7PM sharp after work. Anyone caught outside the gates of their subdivision sectors after curfew will be shot. Remain calm, do not panic. Your neighborhood watch officer will be by to collect urine samples in the morning. Anyone caught interfering with the collection of urine examples will be shot. Stay in your homes, remain calm. The number one enemy of progress is question. National security is more important than individual will. All port broadcasts will proceed as normal. No more than two people may gather anywhere without permission. Use only the drugs prescribed by your boss or supervisor. Shut up, be happy. Obey all orders without question. The comfort you've demanded is now mandatory. Be happy. At last everything is done for you."

Sunday, 15 August 2021

Sunday, 8 August 2021

In summary, everything appears fine, $SP made a new closing all-time high twice this week, but it has not made a new intra-day all-time high since July 29th, so its actually traded in a very tight trading range between 4370 - 4430. A break out of this range in ether direction should give us some momentum.

Friday, 6 August 2021

TLT

Thursday, 5 August 2021

Tuesday, 3 August 2021

Sunday, 25 July 2021

Three out of four major indexes are trading at new highs, Russell 2K is lagging.

Thursday, 15 July 2021

Wednesday, 14 July 2021

"If you have trouble imagining a 20% loss in the stock market, you shouldn't be in stocks."

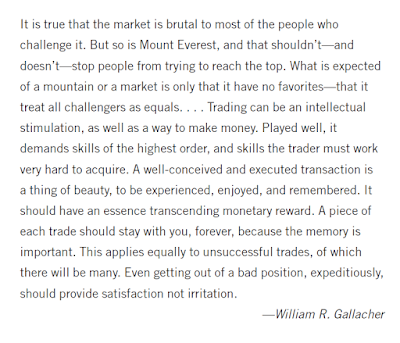

The market moves in probabilities. It's all about what's most likely to happen, but it's also about what could happen.

"Pilots are taught to always be ready for emergencies. And you prepare for the unknown by simulating engine failures and mechanical issues. Then if you actually experience an emergency during a flight, you've already planned out your course of action."

Losses happen. Even if your analysis is spot on, and your thesis is well-articulated, the market can move against you.

The key is to be ready for emergencies in your portfolio. Have a "line in the sand" clearly defined for any new position.