Friday, 28 June 2019

Wednesday, 26 June 2019

Tuesday, 25 June 2019

End of quarter.

Yesterday was a tough day for momentum stocks especially software stocks which took the biggest hit of the day though a few stocks did make some minor gains. The last week in June is often tough as we end the quarter and have the Russell indexes rebalancing. The first few weeks in July are usually better with earnings starting around July 20th.

Monday, 24 June 2019

Friday, 21 June 2019

From the book: Trade Like a Stock Market Wizard

- “I never go against the long-term trend.”

- “You can’t predict the market any more than you can predict where the ball will drop during the next spin of a roulette wheel.”

- “...I would never bet on my fundamental ideas alone without confirmation from the actual price action of the underlying stock.”

- “Let the strength of the market tell you where to put your money, not your personal opinion…”

- “Markets are far more often correct than are personal opinions or even expert forecasts.”

- “If the stock doesn’t act as expected, that’s a major red flag.”

- “A stop-loss regime is essential.”

- “Inevitably, however, a good stop-loss practice will shake you out of some winning stocks.”

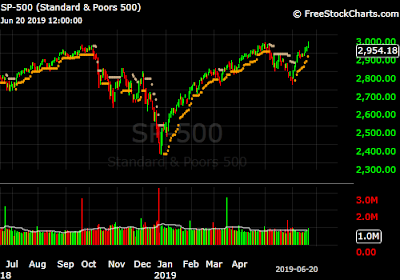

Thursday, 20 June 2019

Wednesday, 19 June 2019

"Recap June 19"

Sunday, 16 June 2019

Thursday, 13 June 2019

Wednesday, 12 June 2019

Tuesday, 11 June 2019

Friday, 7 June 2019

Thursday, 6 June 2019

Tuesday, 4 June 2019

"Recap June 4"

|

Remarks from Fed chairman Jerome Powell that the FOMC “will act as appropriate to sustain the expansion” helped spur a steep rally in stocks, as the S&P 500 gained 2% and the tech-heavy NYSE FANG+ Index enjoyed a 4% rebound. But Treasury yields also jumped across the curve after a sharp recent rally, perhaps suggesting that today’s action was more of a bounce off recent moves than a sea-change in investor perception.

|

"TRADING AND INVESTING ARE VERY DIFFERENT ACTIVITIES"

It is important to be clear about the differences between the two.

"Trading" is simply the exchange of money for an asset, an exchange made with the clear and definite intent or hope of later trading that asset back for more money. Since these assets are bought to be sold rather than bought to be owned, what they happen to be is essentially immaterial.

"Investing," on the other hand, is the purchase of an asset without any pre-intent to sell. Family businesses, cabins at a lake or in the mountains, cottages at the seashore, fine art and jewelry, collections of any kind (stamps, coins, etc.)—assets such as these tend to be investments. They are not bought with the sole intent of selling or trading them later. They are bought to be used and possessed. Consequently, what they are is all important.

Traders are not confused about what they do; they trade. They trade money for positions (in a market), and then later trade those positions back for more or less money. However, some self-described investors tend to mistakenly believe they are making investments, when in reality they are simply making long-term trades. The truth is that many selfdescribed "investors" are actually just long-term traders. Assets bought to be sold are trades, not investments.

An individual truly investing in the stock market should, regardless of the size of the investment (one share or a hundred million shares), act as if he or she were buying the entire company as a family business. This approach to buying stocks might be called the Warren Buffet style of investing. When Mr. Buffet buys shares in a company, he always acts as if he were buying the entire company and planning on it becoming the family business for generations to come, although he might sell these shares at any time.

Conversely, some traders mistakenly act as if they are investors, when in reality they are merely intermediate-term or long-term traders, meaning they waste time and energy worrying about the supposed underlying value of the asset they are trading. As a result they focus too much on whether the price is "high" or "low." This is a waste of time and energy, because from a trader's perspective the whole concept of "value" is essentially meaningless. In free markets, prices can always go higher or lower than current levels, regardless of any perceived or supposed "value." The concept of high and low (i.e., value) essentially does not exist in trading.

Traders need to focus on price movement and should not get distracted by "value." Investors, on the other hand, should focus on value and not be too distracted by short-term price movement. For traders it is price movement that counts, not price location ("high" or "low"). When trading, regardless of the time frame, it is higher and lower that are significant, not high or low.

So, be clear about what you are doing—trading or investing—and act accordingly.

"Trading" is simply the exchange of money for an asset, an exchange made with the clear and definite intent or hope of later trading that asset back for more money. Since these assets are bought to be sold rather than bought to be owned, what they happen to be is essentially immaterial.

"Investing," on the other hand, is the purchase of an asset without any pre-intent to sell. Family businesses, cabins at a lake or in the mountains, cottages at the seashore, fine art and jewelry, collections of any kind (stamps, coins, etc.)—assets such as these tend to be investments. They are not bought with the sole intent of selling or trading them later. They are bought to be used and possessed. Consequently, what they are is all important.

Traders are not confused about what they do; they trade. They trade money for positions (in a market), and then later trade those positions back for more or less money. However, some self-described investors tend to mistakenly believe they are making investments, when in reality they are simply making long-term trades. The truth is that many selfdescribed "investors" are actually just long-term traders. Assets bought to be sold are trades, not investments.

An individual truly investing in the stock market should, regardless of the size of the investment (one share or a hundred million shares), act as if he or she were buying the entire company as a family business. This approach to buying stocks might be called the Warren Buffet style of investing. When Mr. Buffet buys shares in a company, he always acts as if he were buying the entire company and planning on it becoming the family business for generations to come, although he might sell these shares at any time.

Conversely, some traders mistakenly act as if they are investors, when in reality they are merely intermediate-term or long-term traders, meaning they waste time and energy worrying about the supposed underlying value of the asset they are trading. As a result they focus too much on whether the price is "high" or "low." This is a waste of time and energy, because from a trader's perspective the whole concept of "value" is essentially meaningless. In free markets, prices can always go higher or lower than current levels, regardless of any perceived or supposed "value." The concept of high and low (i.e., value) essentially does not exist in trading.

Traders need to focus on price movement and should not get distracted by "value." Investors, on the other hand, should focus on value and not be too distracted by short-term price movement. For traders it is price movement that counts, not price location ("high" or "low"). When trading, regardless of the time frame, it is higher and lower that are significant, not high or low.

So, be clear about what you are doing—trading or investing—and act accordingly.

Monday, 3 June 2019

Subscribe to:

Posts (Atom)