Wednesday, 30 September 2020

Sunday, 27 September 2020

Where does the market go from here ?

Monday, 21 September 2020

Sunday, 20 September 2020

Friday, 11 September 2020

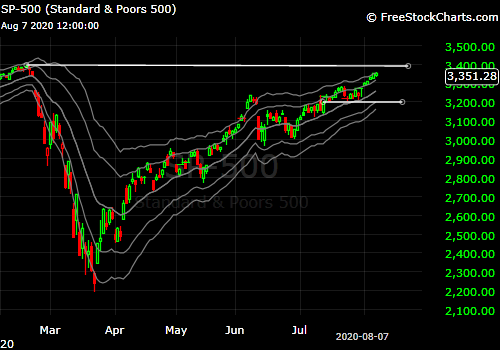

The state of the stock market.

From a technical standpoint, the market was extremely over-bought (and continues to be), so a pullback like this is very normal. There are plenty of non-normal things about the market right now, but a rapid pullback after a rapid rise is not one of them. If the pullback keeps going it could turn into another story, but it’s not there yet.

Until SP-500 breaks support at 3280, the SP chart will not be bearish. If we break support, then a more severe downside move will most likely to follow.

Wednesday, 9 September 2020

Thursday, 3 September 2020

Tuesday, 1 September 2020

Nasdaq exploring new high ground.

Nasdaq rallies into new high ground, but fewer and fewer stocks are supporting the rally. The % of Nasdaq stocks above their own 50-dma has been diverging as it did before market pullbacks in February 2019 and March 2020. "This suggests you should sell into a melt up"

Sunday, 30 August 2020

The path of least resistance is to the upside.

Thursday, 27 August 2020

Wednesday, 26 August 2020

Are you ready for tomorrow ?

Thursday, August 27. tomorrow at 6:10 AM PST, Chairman Powell will release a speech addressing the new policy framework for the Fed from a virtual Jackson Hole central bank meeting. This event has the potential to move market considerably--both up and down--if certain topics are addressed or not addressed.

Last week shortly after the release of the FOMC minutes, many of the markets that had demonstrably rallied (precious metals, Euro etc.) sold off sharply. The ostensible reason was the circumspect lines in the minutes vis-a-vis a the Fed's feelings towards a Yield Curve Control policy. None of this should have come as a surprise to markets but it highlights the chance for some intraday volatility and how the general lack of liquidity in the markets now can create some fireworks.

The trigger for a sell off tomorrow in gold and risk assets will be if Powell's speech inexplicably fails to address the openness of the Fed has to an inflation overshoot.

The base case for most market participants is the Fed comes out and acknowledges their chronic failure to reach their inflation target of 2 percent, and that letting inflation run above this for some reasonable/unspecified time as deemed appropriate/consistent with the incoming data is wholly consistent with their mandate/new framework.

There is the possibility Powell's speech talks about more QE being needed and I think such mention could send the algos buying gold, however, the takeway I'm looking for is what can be gleaned in terms of how long the overshoot lasts.

Sunday, 23 August 2020

In summary, SP's still look positive, that is the most important market indicator, and if SP-500 doesn't break support at 3200 the price trend will remain higher. So, there is no panic, SP-500 is trading around all time highs and it's all good for now, but you better be very observant next 4 to 6 weeks.

Friday, 21 August 2020

Wednesday, 19 August 2020

Saturday, 15 August 2020

Friday, 14 August 2020

"A few things you need to achieve exceptional results"

1) Quantity: You take lots of shots.

2) Quality: You take thoughtful shots.

3) Consistency: You keep shooting for a long time.

4) Feedback. You take better shots over time.

5) Luck: You get a few favorable bounces.

Saturday, 8 August 2020

In summary, the market seems to be running out of gas, but undeniably still going and holding above support. So the bulls remain in charge unless SP breaks down below support at 3200.