Monday, 23 May 2016

Sunday, 22 May 2016

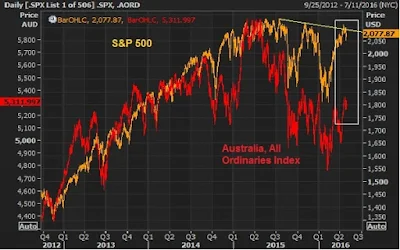

markets now

Following the release of the minutes on Wednesday, Fed funds futures rates showed that investors doubled the likelihood of a rate increase from the Fed in June, to 34 percent from 17 percent, according to CME group's FedWatch tool.

However, on Thursday markets rebounded from Wednesday's sell-off, and priced down the odds of a Federal Reserve interest rate increase after remarks from New York Fed President William Dudley.

The likelihood of a June interest rate hike fell to 26 percent after Dudley's speech on Thursday.

However, on Thursday markets rebounded from Wednesday's sell-off, and priced down the odds of a Federal Reserve interest rate increase after remarks from New York Fed President William Dudley.

The likelihood of a June interest rate hike fell to 26 percent after Dudley's speech on Thursday.

Wednesday, 18 May 2016

Tuesday, 3 May 2016

Trading

"Identifying a pattern is a relatively easy task in which to gain competence. Trading a pattern once identified – now that is a horse of a different color.

How many times have you heard another trader say (or said to yourself): “I knew that stock XYZ was going to go up, and it did, but I did not make a dime on the move?”

Trade signaling, in my opinion, is far less important to net profitability than is proper trading tactics and aggressive risk management protocols."

Subscribe to:

Comments (Atom)