One day at a time, today we got an inside day and can go ether way, and trading back at the top of the range, the line of least resistance continues to be upward.

What to do when in a range? As the trend rider, there's not much to do when

a market is stuck in a range. Manage your open positions and just sit on your hands. If it rallies out of

that range-and sticks, then you look to buy. If it sells off out of that range

and continues lower, then you look to short. It's that simple. I used the

word simple and not easy. If it were easy, everybody would be doing

it.

Tuesday, 16 April 2013

Monday, 15 April 2013

Saturday, 13 April 2013

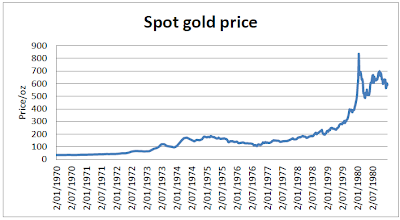

How much further could gold fall?

The truth is that no-one knows.

The 1970s can offer insights. The gold price from 1974-1976 corrected 47% before it rose 8x to peak at US$887/oz in 1980. Extraordinarily, the price increased 4x in the 13 months before the peak.

The 1970s can offer insights. The gold price from 1974-1976 corrected 47% before it rose 8x to peak at US$887/oz in 1980. Extraordinarily, the price increased 4x in the 13 months before the peak.

Friday, 12 April 2013

commitment is the game and fulfillment is the aim

"I would sometimes think that maybe I ought to stop trading because it was

very painful to keep losing. In 'Fiddler on the Roof,' there is a scene where

the lead looks up and talks to God. I would look up and say, 'Am I really that

stupid?' And I seemed to hear a clear answer saying, 'No, you are not stupid.

You just have to keep at it.' So I did."

- Michael Marcus

Market Wizard, is noted for turning $30,000 into $80 million. If

even he started out taking enough lumps to generate serious self-doubt, how can

traders learning in today's environment expect less of a persistence

breakthrough challenge?

Subscribe to:

Comments (Atom)