Friday, 21 August 2020

Wednesday, 19 August 2020

Saturday, 15 August 2020

Friday, 14 August 2020

"A few things you need to achieve exceptional results"

1) Quantity: You take lots of shots.

2) Quality: You take thoughtful shots.

3) Consistency: You keep shooting for a long time.

4) Feedback. You take better shots over time.

5) Luck: You get a few favorable bounces.

Saturday, 8 August 2020

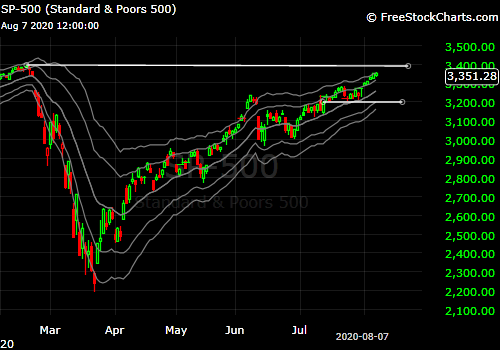

In summary, the market seems to be running out of gas, but undeniably still going and holding above support. So the bulls remain in charge unless SP breaks down below support at 3200.

On your long equity positions raise stops and enjoy the ride.

Monday, 3 August 2020

Friday, 31 July 2020

Saturday, 18 July 2020

Thursday, 16 July 2020

Market still sidways, but don't complain:

“Sister, there are people who went to sleep all over the world last night, poor and rich and white and black, but they will never wake again. Sister, those who expected to rise did not, their beds became their cooling boards, and their blankets became their winding sheets. And those dead folks would give anything, anything at all for just five minutes of this... So you watch yourself about complaining, Sister. What you're supposed to do when you don't like a thing is change it. If you can't change it, change the way you think about it. Don't complain.”

Sunday, 12 July 2020

Ready to take off ?

Which way ? One way or the other, but be ready for a large directional move when we do break out. On your long equity positions raise stops and enjoy the ride.

Thursday, 9 July 2020

Friday, 3 July 2020

QQQ

Bearish divergence, divergences against the trend are usually short lived, but worth noticing in the context, also often after three pushes up there is an ABC formation. Coming week will be an important tell one way or the other.

Thursday, 2 July 2020

Wednesday, 1 July 2020

Tuesday, 30 June 2020

Monday, 29 June 2020

The market has stalled out recently. In the near-term, the bulls would like to see a close of the gap on the island, while the bears are looking for a breakdown below support. From a longer-term perspective, the picture is still one of caution, as the bulls won't fully be in charge until VIX closes below its 200-day moving average.

Subscribe to:

Posts (Atom)