Monday, 15 April 2013

Saturday, 13 April 2013

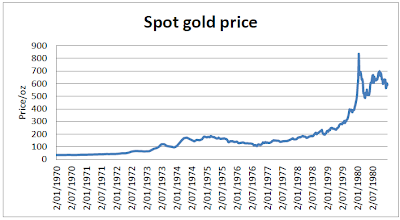

How much further could gold fall?

The truth is that no-one knows.

The 1970s can offer insights. The gold price from 1974-1976 corrected 47% before it rose 8x to peak at US$887/oz in 1980. Extraordinarily, the price increased 4x in the 13 months before the peak.

The 1970s can offer insights. The gold price from 1974-1976 corrected 47% before it rose 8x to peak at US$887/oz in 1980. Extraordinarily, the price increased 4x in the 13 months before the peak.

Friday, 12 April 2013

commitment is the game and fulfillment is the aim

"I would sometimes think that maybe I ought to stop trading because it was

very painful to keep losing. In 'Fiddler on the Roof,' there is a scene where

the lead looks up and talks to God. I would look up and say, 'Am I really that

stupid?' And I seemed to hear a clear answer saying, 'No, you are not stupid.

You just have to keep at it.' So I did."

- Michael Marcus

Market Wizard, is noted for turning $30,000 into $80 million. If

even he started out taking enough lumps to generate serious self-doubt, how can

traders learning in today's environment expect less of a persistence

breakthrough challenge?

follow up; UNG and SMH trades

now needs a break out and a follow through

stopped out at break even on a half position after taking 1R profit on the first half

Wednesday, 10 April 2013

advance through trial and error

Do not think that what is hard for you to master is humanly impossible; and if it is humanly possible, consider it to be within your reach.

~Marcus Aurelius

~Marcus Aurelius

Monday, 8 April 2013

just a reminder, QE

"As more and more money gets printed, currencies will

inevitably devalue and hard assets including stocks will rise. Should inflation

start to run rampant, stock markets, as history has shown, could start to rise

in a parabolic manner. One would hope central banks would slow QE to prevent

this from happening, as the aftermath of such a stock market bubble is always

catastrophic."

Friday, 5 April 2013

Thursday, 4 April 2013

a trader is a person who earns what he gets...

"The symbol of all relationships among such men, the moral symbol of

respect for human beings, is the trader. We, who live by values, not by loot are

traders, both in manner and spirit. A trader is a man who earns what he gets and

does not give or take the undeserved. A trader does not ask to be paid for his

failures, nor does he ask to be loved for his flaws. A trader does not squander

his body as fodder, or his soul as alms. Just as he does not give his work

except in trade for material values, so he does not give the values of his

spirit-his love, his friendship, his esteem-except in payment and in trade for

human virtue, in payment for his own selfish pleasure, which he receives from

men he can respect."

~from Atlas Shrugged

~from Atlas Shrugged

Wednesday, 3 April 2013

Tuesday, 2 April 2013

Monday, 1 April 2013

Monday, 25 March 2013

“bandwagon” theory

Traders often hear about “tulip mania,”

the “South Sea bubble” and other similar events where traders have followed the

crowd to send prices to extreme levels. You might add the technology dot.com

bubble of the late 1990s or the more recent housing bubble to the list of those

events where traders got carried away with higher and higher prices. Everyone

wanted to be part of the action – the “crowd

psychology” or “bandwagon” theory. The same type of crowd response

applies to price action on a smaller scale, too. For example, when a market is

coming up from a basing area on the charts, “smart money” is responsible for the

majority of the initial buying. As people jump on board, we

see the bandwagon effect, and that bandwagon pushes prices up. Volume tends to surge at its

peak, certainly on the buy side, during the markup phase in the middle. Later,

toward the end of the trend, smart money is not doing the buying; somebody else is. The smart

money is doing the selling. The market tops by rolling over or sometimes with a spike top. We

can see the crowd impact expressed in price and in volume. Just think about what happens

among professional traders when the stock market goes up even when the fundamentals don’t

provide much support for such a move. Prices often rise because institutional money managers

feel pressured to follow the crowd and chase performance. How can they explain why their

results are below the industry benchmarks if they don’t go with the crowd and buy the stocks

everyone else has in their portfolios? That rationale alone can

drive markets

higher than they “should” go.

Friday, 22 March 2013

trend trading, momentum, swing, price action, trading futures & equities

"If you are ready to give up everything else - to study the whole history and background of the market ... as a medical student studies anatomy. If you can do all that, and, in addition, you have the cool nerves of a gambler, the sixth sense of a kind of clairvoyant, and the courage of a lion, you have a ghost of a chance."

---Bernard Baruch

---Bernard Baruch

Wednesday, 20 March 2013

I think that expertise is the connection between knowing and doing.

"Some degree of derivative learning is necessary - BUT - much learning does not teach understanding. Only through experience and extensive practice and application will understanding and expertise arise."

-Heraclitus, 475 BC

New trader to Master Trader:

"Sir, what is the secret of your success"? "Two words."

"And, sir, what are they?" "Right decisions."

"And how do you make the right decisions." "One word."

"And, sir, what is that one word?" "Experience."

"And, sir, how do you get experience?" "Two words."

"And, sir, what are those two words?" "Wrong decisions."

Tuesday, 19 March 2013

S&P 500 cash market analysis and outlook

the line of least resistance is upward and this pullback is going to present us with a new menu with new low risk setups, manage open positions and be patient with initiating new ones, and for you that want to short now, plain and simple don't, if the market is going to tank there is going to be plenty of time to get on board, read the post below and don't predict, but follow your proven game plan

Monday, 18 March 2013

Friday, 15 March 2013

Are you prepared ?

"Being

prepared, on a few occasions in a lifetime, to act promptly in scale in doing

some simple and logical thing will often dramatically improve the financial

results of that lifetime. A few major opportunities, clearly recognisable as

such, will usually come to one who continuously searches and waits, with a

curious mind, loving diagnosis involving multiple variables. And then all that

is required is a willingness to bet heavily when the odds are extremely

favourable, using resources available as a result of prudence and patience in the

past."

-

Charlie Munger

Subscribe to:

Comments (Atom)

++01_06_2012+-+14_11_2012ng.jpg)