Tuesday, 31 December 2019

facts & thought

In 2019, the ratio between stocks and commodities hit a 100-year low. As we end 2019, the ratio has contracted some but can shrink much more in 2020. Since 1979, inflation has remained muted. Given statements by Steven Kaplan, the President of the Dallas Reserve, that interest rates will remain low and the future of the dollar as the world’s reserve currency is questionable, the best trades for 2020 could be in commodities.

Friday, 27 December 2019

The Fear Of Missing Out (FOMO) appears to be showing up in recent days.

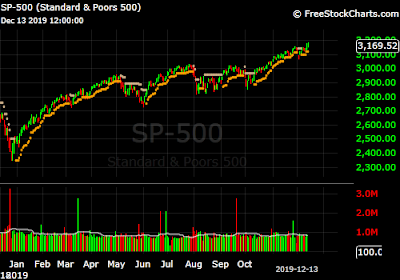

$SPX and other major indices are roaring ahead, despite a relatively narrow number of stocks participating.

The seasonal period ("Santa Claus Rally" and the end of the post-Thanksgiving seasonal) runs through Friday, January 3rd. That doesn't mean the market will abruptly fall at that time, but it does mean that it won't have the benefit of seasonality after that date.

In summary, the outlook is bullish. A market like this can produce complacency, but that is the one thing we can control. We can and must avoid becoming complacent. But, for now, enjoy the ride.

The seasonal period ("Santa Claus Rally" and the end of the post-Thanksgiving seasonal) runs through Friday, January 3rd. That doesn't mean the market will abruptly fall at that time, but it does mean that it won't have the benefit of seasonality after that date.

In summary, the outlook is bullish. A market like this can produce complacency, but that is the one thing we can control. We can and must avoid becoming complacent. But, for now, enjoy the ride.

Tuesday, 24 December 2019

Friday, 20 December 2019

The market could hardly be stronger.

Equity-only put-call ratios are in very overbought territory, but they haven't been able to generate strong sell signals (as yet).

Market breadth has improved, and breadth oscillators are on buy signals and are in modestly overbought territory.

Volatility remains in the bullish camp. First, the $VIX "spike peak" signal from December 4th remains in place. Second, the trend of $VIX is sideways-to-down, and that is bullish as well.

Thursday, 19 December 2019

Tuesday, 17 December 2019

"People are never more insecure than when they become obsessed with their fears at the expense of their dreams."

The global risk rally ran out of steam today following four bullish sessions. Volatility remains very low on Wall Street, despite the British Prime Minister Boris Johnson's announcement to limit the transition period of the Brexit process, which could increase the risk of a 'hard-Brexit' yet again.

Friday, 13 December 2019

"The cost of borrowing cash overnight on the last day of the year has surged despite the US Federal Reserve’s injection of billions of dollars into markets in an attempt to ease the strain, raising concerns that investors may be in for a volatile final few weeks of 2019."

In summary, the $SP-500 chart is strongly bullish. The only sell signals are from put- call ratios. So if long, stay long and use trailing stops.

Volatility has remained mostly bullish, $VIX remains below 16 on a closing basis and that is bullish.

Saturday, 7 December 2019

Friday, 6 December 2019

Stocks ending week with power following roller-coaster ride.

"The government jobs report was nothing short of spectacular for stock investors, pointing to a textbook 'goldilocks economy' with solid growth and low inflation. Non-farm payrolls increased by 266,000 in November, well above the consensus estimate of 181,000 and last month's revised reading of 156,000. The positive revision in itself is a huge plus for bulls, and the fact that wage growth was a tad lower-than-expected confirms the muted inflationary pressures. The unemployment rate unexpectedly declined to 3.5% as well, matching the measure's recent multi-decade low, thanks to the healthy trends in the labour market."

Monday, 2 December 2019

"Politics will pose the biggest risk to financial markets in December, as the U. S.-Chinese relations could have a crucial effect on risk assets, the impeachment process will also enter its next phase, and the British elections could also cause turmoil in the usually quiet month. The strong rally of the past two months could mean that a choppier period is ahead for stocks, and even an orderly pullback may be in the cards despite the positive seasonality statistics of December. The OPEC meeting, which is scheduled for the first week of the month will likely be a tumultuous one, as Saudi Arabia is trying to pressure the cartel to increase the support of the price of oil ahead of the Initial Public Offering (IPO) of the state owned giant, Aramco."

Sunday, 1 December 2019

“Most professionals agree that novices and amateurs spend far too much time studying entry techniques in relation to their true importance to successful trading. It is risk management, they agree, that really separates the winners and losers. Since the markets are not very predictable anyway, you can have a far greater impact on your bottom line by applying proper risk management techniques than by finding a new and better way to anticipate the next market top or bottom.”

Subscribe to:

Comments (Atom)